Zakat calculation on gold is determined by whether your gold holdings exceed the nisaab (usually 85 grams of gold), and if so, you pay 2.5% of its value after meeting any other qualifying conditions. Below is a thorough guide outlining how to work out your Zakat on...

Zakat calculation on gold is determined by whether your gold holdings exceed the nisaab (usually 85 grams of gold), and if so, you pay 2.5% of its value after meeting any other qualifying conditions. Below is a thorough guide outlining how to work out your Zakat on...

Ensuring you fulfil your obligation to give Zakat need not be complicated. With the ever-evolving financial landscape, many Muslims find it challenging to keep track of their annual Zakat payments. In this detailed guide, we’ll explore how Zakat is calculated, the...

Ensuring you fulfil your obligation to give Zakat need not be complicated. With the ever-evolving financial landscape, many Muslims find it challenging to keep track of their annual Zakat payments. In this detailed guide, we’ll explore how Zakat is calculated, the...

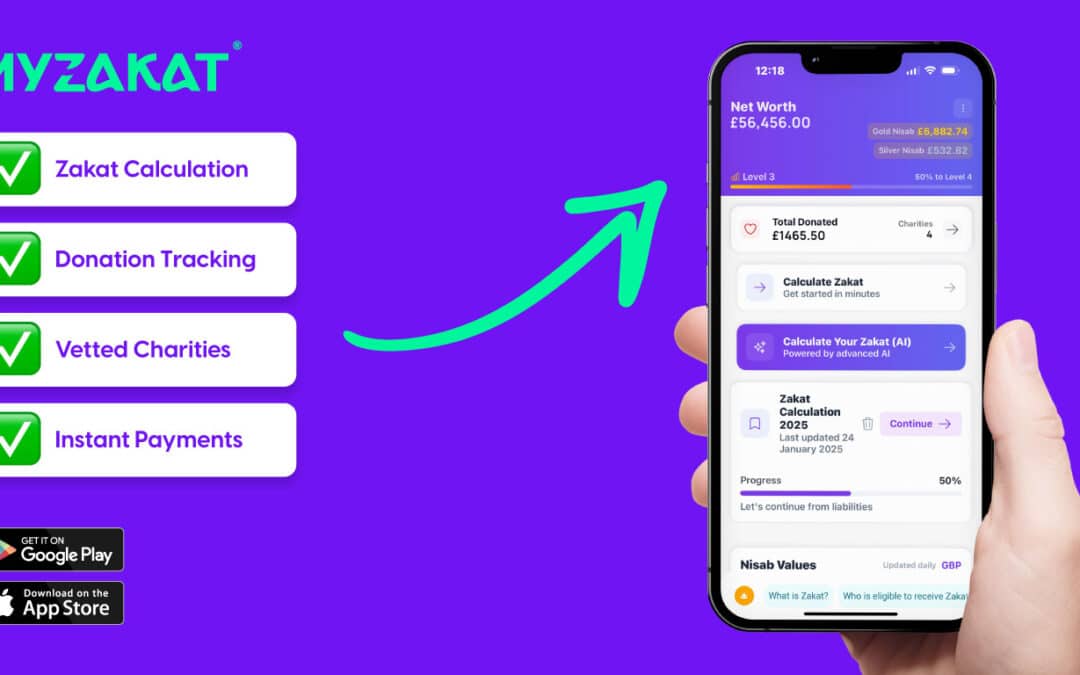

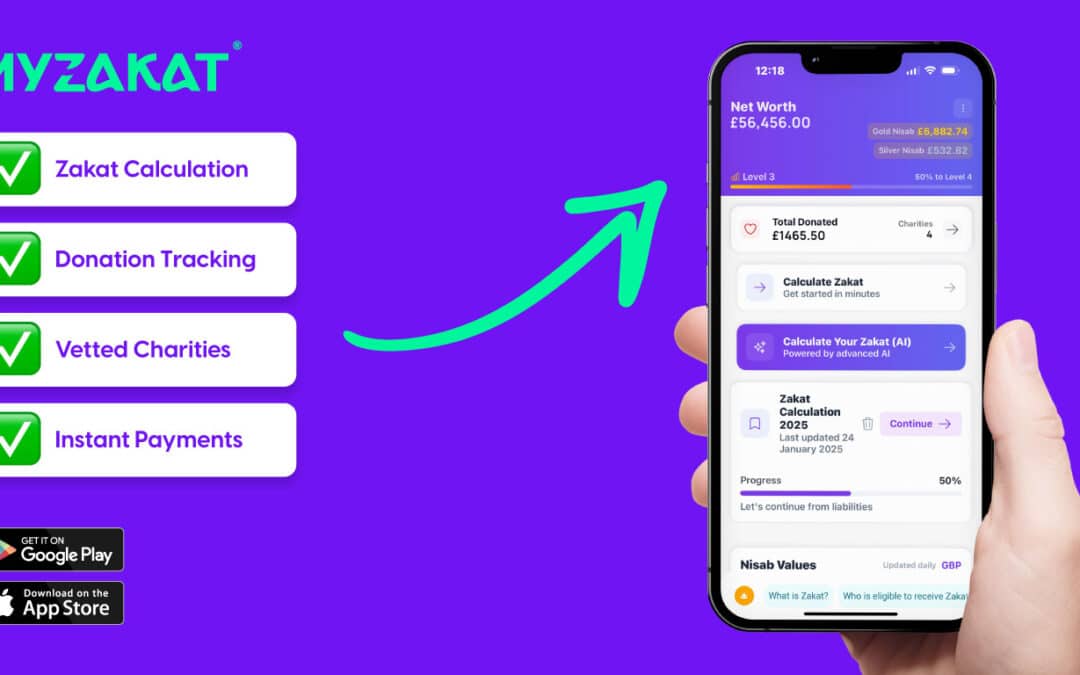

Fulfilling your Zakat obligation has never been easier with MyZakat, a secure and user-friendly platform designed to help Muslims calculate, track, and distribute their Zakat effectively. Whether you’re paying Zakat al-Mal, Zakat al-Fitr, or making a Sadaqah...

Fulfilling your Zakat obligation has never been easier with MyZakat, a secure and user-friendly platform designed to help Muslims calculate, track, and distribute their Zakat effectively. Whether you’re paying Zakat al-Mal, Zakat al-Fitr, or making a Sadaqah...

Zakat is an obligation for all eligible Muslims, including business owners. If you run a business, it’s essential to understand how Zakat applies to your business assets, profits, and liabilities. This guide provides a clear explanation of how to calculate and pay...

Zakat is an obligation for all eligible Muslims, including business owners. If you run a business, it’s essential to understand how Zakat applies to your business assets, profits, and liabilities. This guide provides a clear explanation of how to calculate and pay...

Zakat is a fundamental pillar of Islam and is due on various forms of wealth, including rental income and certain types of property. If you are a landlord or own investment properties, it is crucial to understand how Zakat applies to your assets. This guide will...

Zakat is a fundamental pillar of Islam and is due on various forms of wealth, including rental income and certain types of property. If you are a landlord or own investment properties, it is crucial to understand how Zakat applies to your assets. This guide will...